Trump's New Affordability Solutions: 50 Year Mortgage v. Portable Mortgage Rate

Like him or not, everyone knows that Trump is a good businessman especially in the field of real estate. Also, like it or not, the data is in, and 2025 officially was the worst year for real estate in the past 20 years. Why? It’s simple. There were fewer real estate transactions in 2025 than in any year since 2008, even though our population has increased by about 7 million people since 2008. With the population increase alone, we should have had at least the same number, if not more transactions, even by a little….and there weren’t.

If you see a Realtor who has had sales this year, those sales have come from a lot of hard work. It is not easy, and it is really not easy during the worst year in recent history.

So, I am happy that we have a president who is at least trying to come up with a solution to ease affordability for all Americans. What are these solutions, and will they really work? Let’s examine two recent mortgage ideas proposed by President Trump's administration: the 50-Year Mortgage and the Portable Mortgage.

These concepts aim to address the squeeze felt by many Americans, but like any significant financial tool, they come with a complex set of trade-offs.

The 50-Year Mortgage: A Longer Runway for Homebuying

The 50-Year Mortgage stretches the repayment period of a home loan from the standard 30 years to a full five decades. The primary intention is to lower the required monthly mortgage payment, making homeownership accessible to a wider pool of buyers, particularly first-time and lower-income individuals.

Key Points

- Extended Term: The loan is amortized (paid off) over 600 months instead of 360 months.

- Goal: To reduce the monthly payment amount, which can help prospective buyers meet debt-to-income ratios and afford a more expensive home.

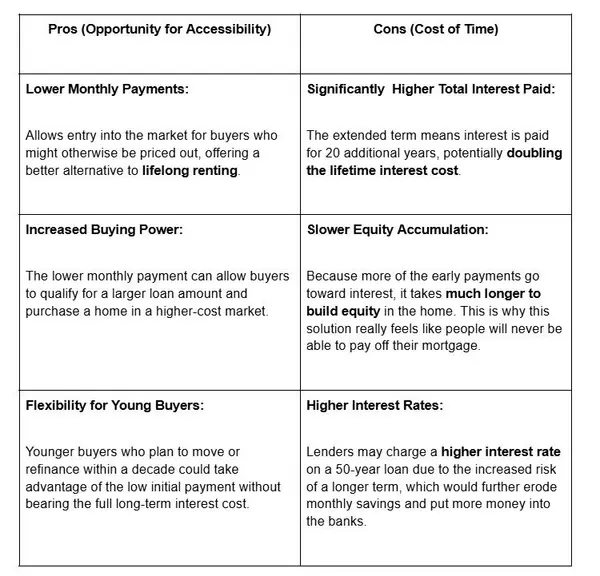

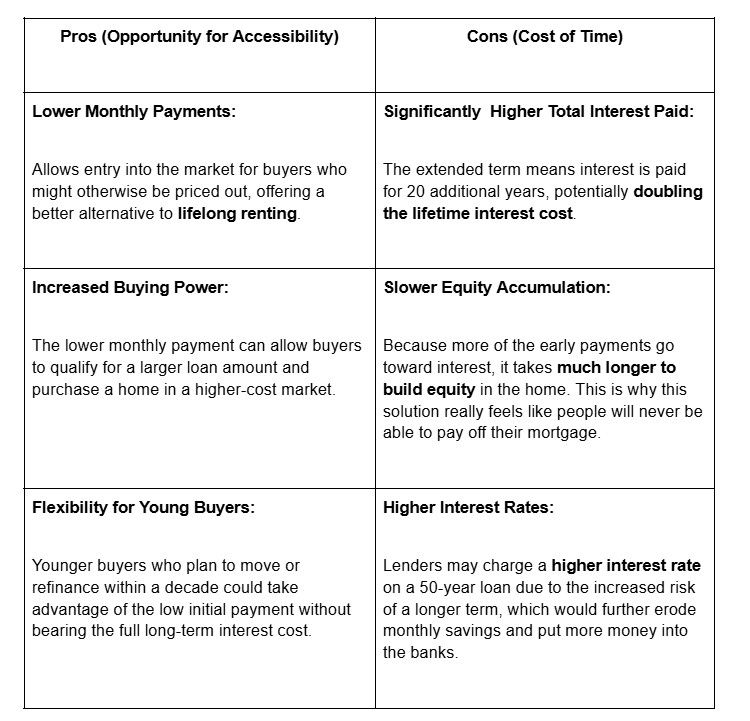

Pros and Cons: A Balanced View

The Portable Mortgage: Moving Your Rate with You

The Portable Mortgage (or "porting") is an idea being explored by the Federal Housing Finance Agency (FHFA) that would allow a homeowner to transfer the interest rate and remaining terms of their existing mortgage to a new property when they move.

Key Points

- Transfer of Terms: You essentially "port" the existing mortgage contract, including its interest rate, to the new home.

- Goal: To eliminate the need to refinance at a potentially higher current market rate when moving, providing stability for homeowners, especially those locked into low, pre-2022 rates.

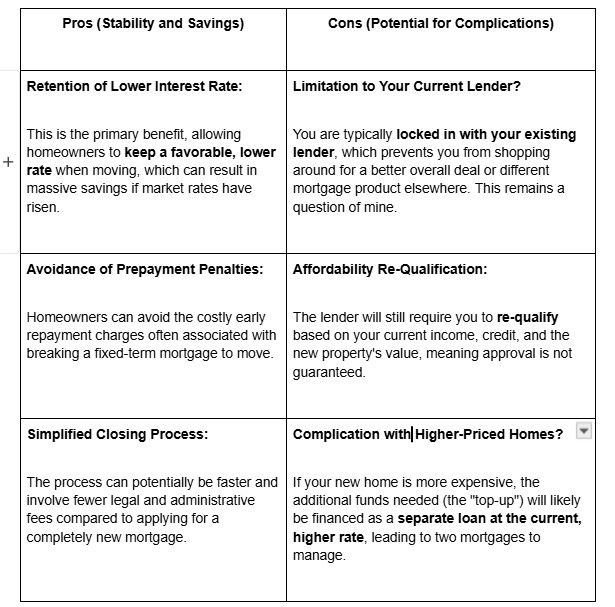

Pros and Cons: A Balanced View

My Power House Conclusion for Houston Homebuyers

As your trusted partners in the Houston real estate market, we approach these ideas with a focus on long-term financial health.

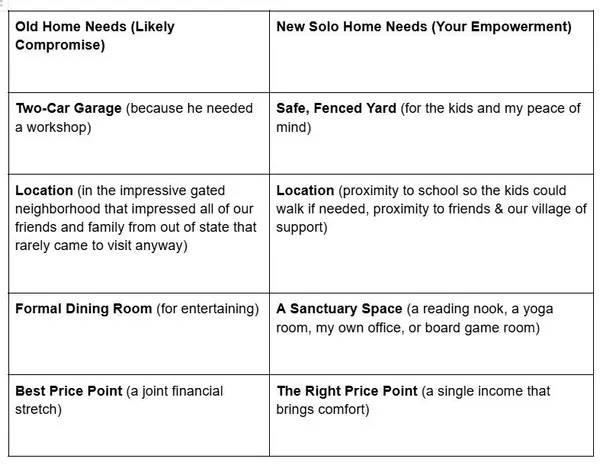

While the 50-Year Mortgage offers an enticing lower entry barrier, it may ultimately cost the buyer significantly more over the long run and severely slow the wealth-building power of home equity. The decision to pursue such a loan would require careful calculation and a clear strategy to pay it off or refinance much sooner than 50 years. This might be a good option IF the interest rate is not different than a 30-year mortgage, and IF there are penalties for paying off the mortgage early. Without those 2 factors, it is hard to see why anyone would choose this as an option.

The Portable Mortgage concept, however, presents a genuinely valuable option for stability in a volatile rate environment. For those who are locked in a low rate and need to move, the ability to port that rate could be a true financial "game-changer." There are still questions with this plan as well. One question I have is whether or not both parties will get to “port” the rate in a divorce situation. I can see where this portable mortgage could be a total game changer for MANY Americans who are currently living in homes that do not really suit their needs, but are too afraid of losing their rate to move. With that, it could totally change how often people move and the affordability of the home they really want for many.

What questions do you have about these 2 unique options posed by our President? I would love to hear your thoughts about these options. Contact me at 832-341-1289 to talk.

- Brittany Cabrera, Your Power House Realtor in Houston

Categories

Recent Posts